One of the most important notions in economics is how people make choices when they don’t have a lot of money. The budget constraint is the idea that best explains this behavior. This idea is very important for making decisions, whether you are a student learning about economics, a business owner keeping track of costs, or a person organizing their monthly expenses. A budget constraint is the maximum amount of money a person can spend based on their income and the prices of products and services. It shows how scarcity makes people make choices and trade-offs.

In this step-by-step guide, we’ll talk about what a budget restriction is, how it works, how to figure it out, and how it works in real life. By the end of this post, you will know exactly why this idea is important and how it affects how people handle their money every day.

Step 1: Knowing what a budget constraint is

The word “budget constraint” refers to the things a person can buy with a certain amount of money at current costs. In short, it sets the limit on what you can afford and what you can’t. The budget constraint shows these restrictions in an organized fashion, because every person, family, or organization has limited resources.

This idea is based on the idea that income stays the same for a certain amount of time and that prices are known. Under these conditions, consumers must decide how to best use their money. The budget constraint doesn’t tell someone what to buy; it just limits what they can buy. Without borrowing, saving modifications, or changes in income, it is impossible to make choices outside of this boundary.

Step 2: The Importance of Budget Constraint in Economics

The budget constraint is important in economics because it helps us understand how people act when there isn’t enough of something. People have to choose which items to buy and how much of them to buy because resources are limited. This limitation aids economists in comprehending demand trends, substitution effects, and opportunity costs.

From a theoretical standpoint, it collaborates with customer preferences to ascertain optimal consumption decisions. Preferences reflect what individuals desire, while the financial limitation tells what they can pay for. It is only possible to accurately examine rational decisions when these two components interact.

Step 3: Parts of a Budget Constraint

To properly grasp a budget limitation, you need to know what its parts are. Income is the most important thing because it establishes the overall limit on how much you can spend. Prices of products and services are the second part, and they tell you how much of each item you can buy. The final amount of products picked shows the result of making a choice within the limit.

The budget limit moves when prices go up or down or when income goes up or down. This change changes the options that are affordable and can have a big effect on how people act. Knowing these parts helps us understand why people change how they spend their money over time.

Step 4: A breakdown of the budget constraint formula

You can use a simple formula to write down the budget constraint quantitatively. Let’s say a person buys two things, X and Y. If I is the income, Px is the price of good X, and Py is the price of good Y, then the formula is:

I = Px × X + Py × Y

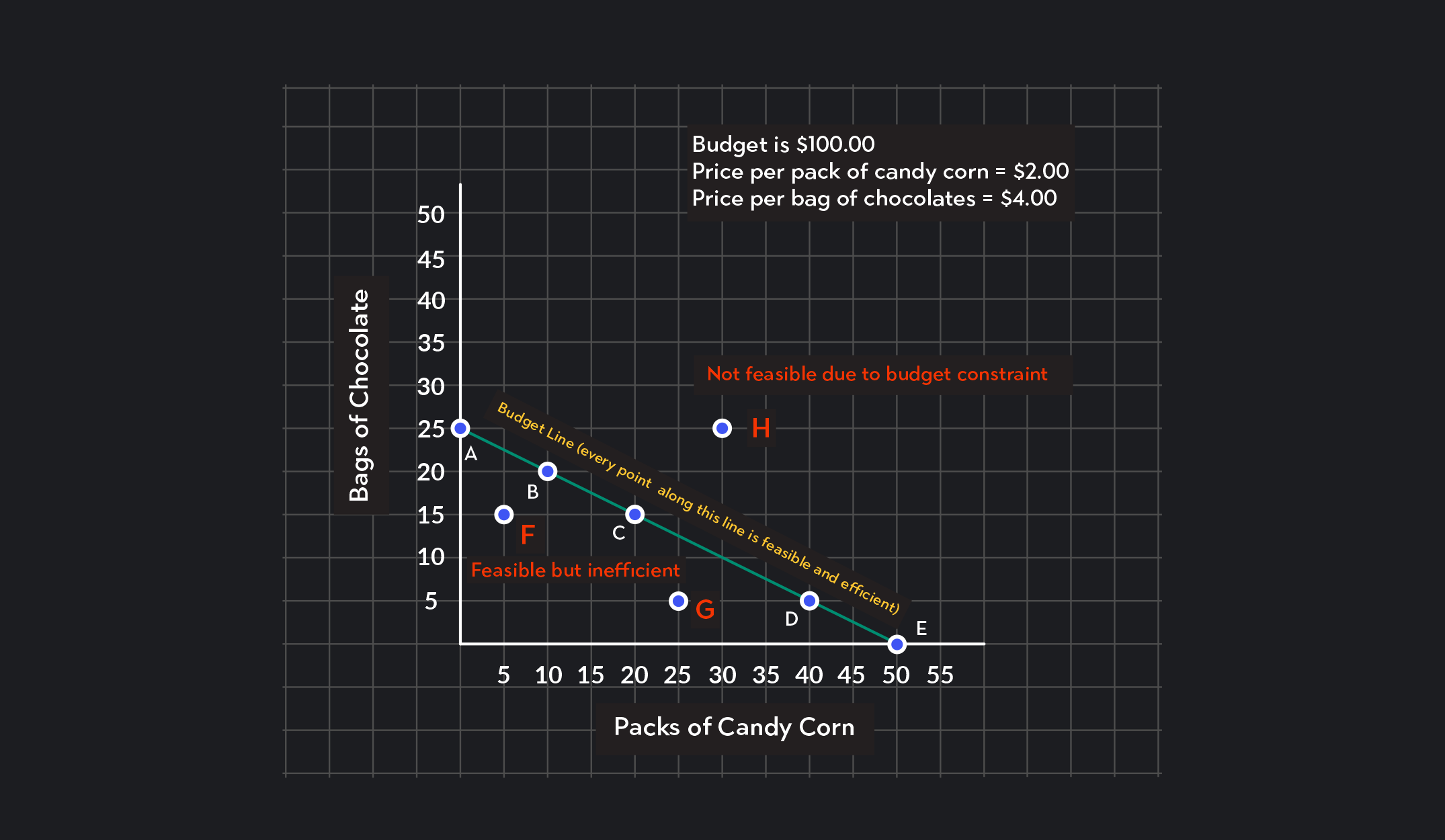

This equation illustrates that the total amount of money spent on items X and Y must be the same as the total amount of money made. The budget constraint line is made up of all the combinations of X and Y that make this equation true. Combinations below the line are cheap and don’t use all of the income, while combinations above the line are too expensive.

Step 5: Putting the Budget Constraint on a Graph

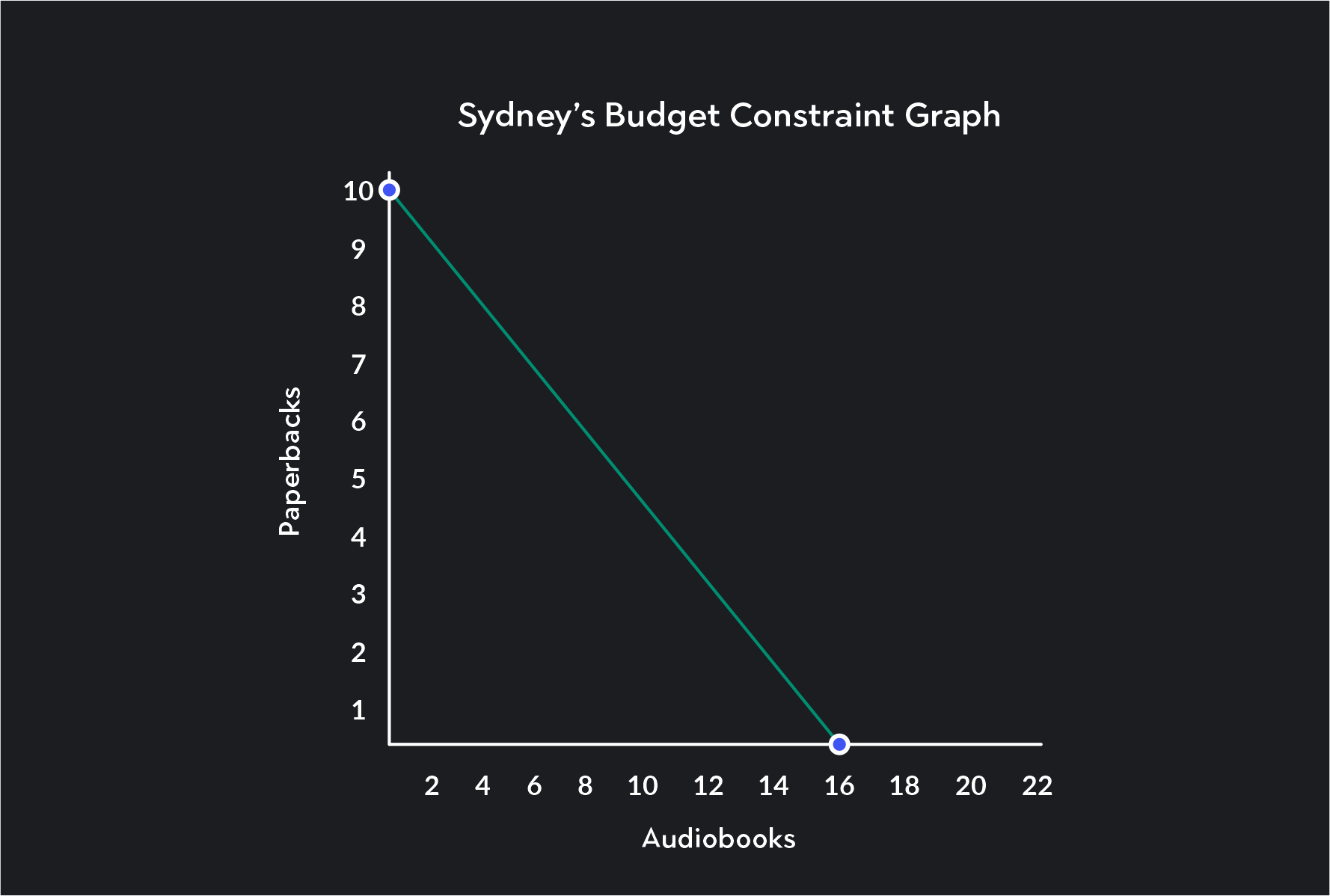

A straight line on a graph is a common way to depict the budget constraint in economics. One good is on the vertical axis and the other is on the horizontal axis. The slope of the line shows how the prices of the two commodities compare.

This graph makes it easy to see the trade-offs. You have to give up part of the other good if you buy more of one. If you only buy one thing with all of your money, the line’s intercepts show the most you can buy of each good.

Step 6: How Changes in Income Change the Budget Constraint

Changes in income have a direct effect on the budget restriction. When prices stay the same but income goes up, the limitation moves outside, making it possible for people to buy more things. This growth makes it easier to buy things and gives people more options for what to buy.

But if your income goes down, the limitation moves in. This limits options and makes people spend less. These changes show why changes in the economy, pay, or unemployment have a big effect on how people live.

Step 7: How changes in price affect the budget constraint

Changes in price are also very important in setting the budget constraint. If the price of one good goes down but income stays the same, people can buy more of that good without cutting back on other things. This makes the budget line turn outward along the axis of the less expensive good.

On the other hand, when prices go up, the ability to buy things goes down. People who want to buy something must either buy less of it or spend their money on cheaper options. This link shows how inflation and changes in the market affect the choices we make every day.

Step 8: Examples of Budget Constraint in Real Life

The budget restriction isn’t just a theory; it has real-world effects. For instance, a student who gets a set amount of money each month has to select how much to spend on food, transportation, and fun. The allowance is the same as income, and the costs of things are the same as prices.

A household that is organizing its monthly spending has to deal with a budget limit when it comes to dividing up its money between rent, utilities, groceries, and savings. When businesses decide how to spend their limited capital on labor, materials, and marketing, they also have to stick to a budget.

Step 9: Cost of Opportunity and Budget Constraint

Opportunity cost is one of the most essential principles that goes along with the budget limitation. Every decision made within the constraint necessitates relinquishing an alternative. If you choose to spend more on fun things, you may have to save less. If you buy high-end items, you may not be able to afford other things you need.

This trade-off is why making decisions is usually not easy. The budget limit makes people think carefully about the pros and drawbacks of their choices, which is a key idea in rational economic behavior.

Step 10: Budget Line vs. Budget Constraint

People often use the terms “budget constraint” and “budget line” interchangeably, but they mean different things. The budget limitation includes all the combinations of items that are within the budget. But the budget line only shows the options that use up all of the money.

Knowing this difference makes economic diagrams and theoretical talks clearer, especially when looking at consumer equilibrium and the best options.

Step 11: How Business and Government Work with a Budget

Governments and businesses also have to stick to their budgets. Businesses have to divide their limited resources between production, marketing, and growth. When it comes to selecting how to spend money on healthcare, education, defense, and infrastructure, governments have to deal with some limits.

In both circumstances, it is very important to use the budget wisely in order to reach long-term goals. Bad planning can cause problems like deficits, inefficiencies, or worse performance.

Step 12: The Budget Constraint Concept’s Limits

The budget restriction is a useful tool for analysis, although it does have certain limits. It presupposes that prices and income stay the same, which may not be the case in markets that change quickly. It also doesn’t take into account things like how easy it is to get credit, how people save money, and how uncertain things are.

Even with these flaws, the idea is still quite valuable since it gives us a clear way to think about making decisions when we don’t have all the information we need.

Conclusion

The idea of a budget limitation is at the basis of both economic theory and real-world financial planning. It shows how restricted resources affect choices, cause trade-offs, and help people make smart decisions. Individuals and organizations may make better and faster decisions if they know what it means, how to use it, how to graph it, and how it works in the actual world.

The budget restriction is a reminder that scarcity is a fact of life and that choices always involve giving up something. This is true for personal budgeting, company strategy, and public policy. Mastering this idea gives you the power to plan for a more stable financial future and use your resources wisely.

Read More:- Constraint on Bavayllo: Key Challenges, Rules, and Impacts